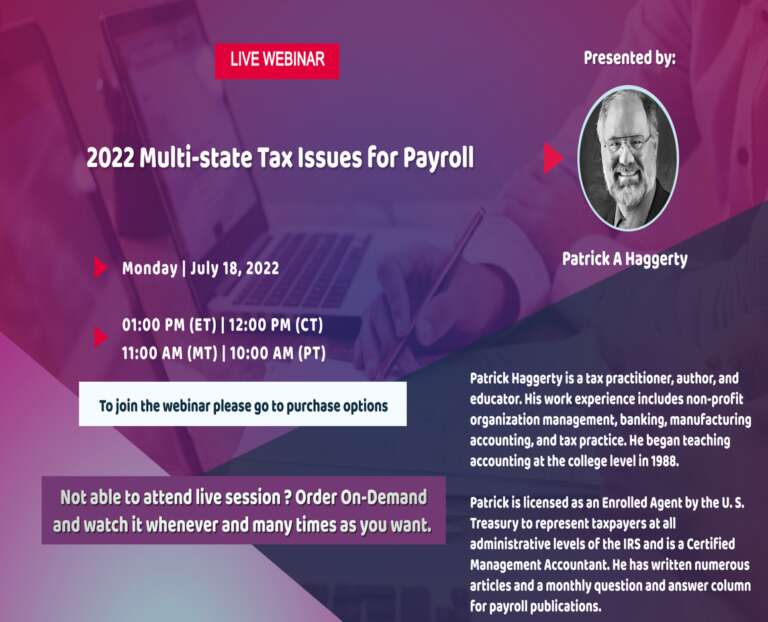

Overview

There are significant compliance issues for employers when employees cross state lines in the course of employment. Frequently, multi-state employment issues arise when the employer has business locations in more than one state. However, issues also arise when individual employees perform services in more than one state, live in one state and work in another, move from one state to another, or telecommute across state lines. This session will discuss working from home when work and home are in different states and address working from home due to COVID.

Compliance issues directly related to payroll include identification of the states for which the business is liable for the collection and payment of income tax, and compliance with the rules for each state regarding tax collection, payment and reporting. In addition, special rules are used to establish the state that is to receive the unemployment tax for a particular employee. A very significant non-payroll issue is whether the employment creates nexus, i.e. a business presence, within a particular state and whether the employer is subject to that state’s income, franchise, sales and use, or other state business taxes imposed by the state and the related apportionment issues.

Why Attend

Creation of nexus in a new state or local tax jurisdiction creates tax and compliance issues for a business such as liability of business income, franchise, property, sale taxes, employment taxes, and apportionment, and reporting compliance issues. Employers can inadvertently create nexus when employees work within a taxing jurisdiction. Failure to properly withhold or pay taxes to the appropriate jurisdiction can lead to fines and penalties as well as employer liability and possible personal liability of employer officers and managers for under with held employee taxes. Correcting errors after the fact can be an expensive and time-consuming process. Employers must exercise due diligence in obtaining and documenting the information used to compute employee withholding in order to avoid penalties for withholding or reporting errors or missing information. This webinar will provide you with information on required documentation and ways to avoid problems and penalties.

Areas Covered

- Reciprocal agreements and how they affect state income tax withholding

- Employee domicile and tax residency

- State and local withholding certificates- when the federal W-4 isn’t enough

- How different states deal differently with supplemental wages

- How to handle state unemployment when employees work in several states

- SUTA dumping- what it is and how to avoid this penalty trap

- Which states get withholding tax proceeds when employees work in multiple states

- Fringe benefit taxation- which states differ from federal rules

- The payroll tax implications of conducting business in a state

- How to determine the states for which you must withhold tax

- Special rules for military spouses

- Telecommuting and working from home under COVID restrictions

Who Will Benefit:

- Payroll Supervisors and Personnel

- Payroll Consultants

- Payroll Service Providers

- Public Accountants / Enrolled Agents

- Internal Auditors / Tax Compliance Officers

- Employee Benefits Administrators

- Officers and Managers with Payroll or Tax Compliance Oversight

- Company / Business Owners

- Managers/ Supervisors

- Public Agency Managers

- Audit and Compliance Personnel / Risk Managers