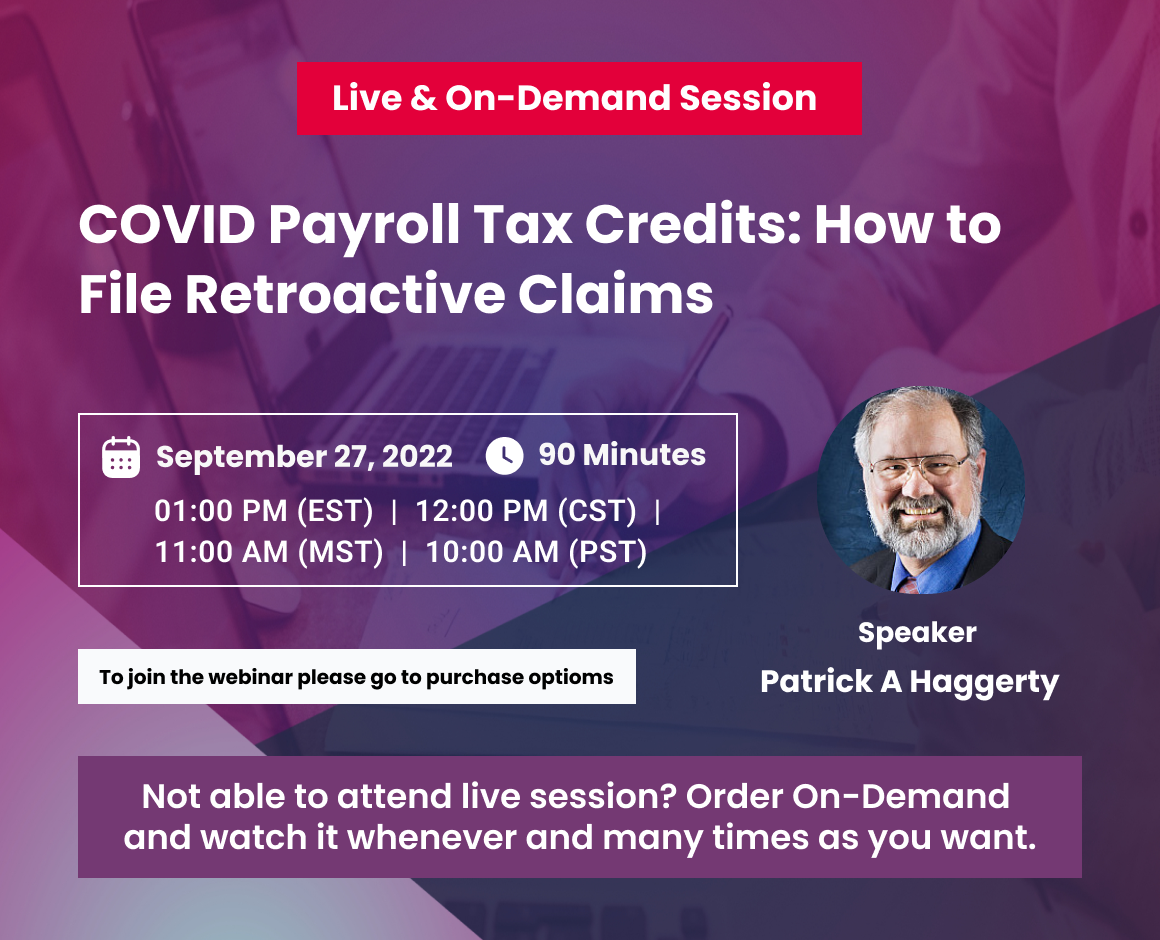

Overview

This webinar will cover the use of Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, claim additional allowable Employee Retention Credits or Sick and Family Leave Credits due to COVID. It will cover the qualification requirements for the credits and how to claim and correction of previously reported amounts where eligible credits were under reported.

Description

During to the COVID-19 pandemic, Congress provided payroll tax credits for employers to provide relief to employers for payment of qualifying sick and family leave wages and employee retention wages. As the pandemic stretched out, there were extensions and changes to the tax credit eligibility requirements, maximum amounts, and affected taxes. In response to those changes, Form 941 and the related worksheets when through several major revisions. While the tax credits have expired, employers may still file retroactive claims for unclaimed eligible credits and correction of previously reported amounts.

This webinar discusses the methods employers may use to claim or adjust these tax credits.

Areas Covered:

• Changes to the definition of qualifying wages throughout 2020-2021.

• Changes to the definition of qualifying employers and employees.

• Which taxes are used to claim the credits.

• What constitutes wages for purposes of computing the credits

• Amounts that may be claimed in addition to wages.

• Interaction of PPP loans and COVID tax credits.

• Claiming credits on Form 941-X - line by line.

• How to use the worksheets from Form 941-X and Form 941 to compute the credits.

Learning Objectives

As a result of this session, you should:

• Know how to prepare for 941-X to claim an adjustment or refund for COVID tax credits

• Know how to use Form 941-X worksheets to compute eligible wages and taxes

• Identify eligible wages

• Know the filing due dates for Forms 941-X

Why you should attend

The rules for claiming the COVID tax credits changed several times during 2020-2021. Some employers may have missed claiming credits they were entitled to claim. This webinar covers the changes and the process for correcting errors or claiming unused credits.

Who will benefit

• Payroll Supervisors and Personnel

• Public Accountants and Enrolled Agents

• Internal Auditors

• Tax Compliance Officers

• Officers and Managers with Tax Compliance Oversight

• Company / Business Owners

• Managers/ Supervisors

• Public Agency Managers

• Audit and Compliance Personnel / Risk Managers

Speaker

Patrick A Haggerty, EA

Patrick Haggerty is a tax practitioner, author, and educator. His work experience includes non-profit organization management, banking, manufacturing accounting, and tax practice. He began teaching accounting at the college level in 1988.

He is licensed as an Enrolled Agent by the U. S. Treasury to represent taxpayers at all administrative levels of the IRS and is a Certified Management Accountant. He has written numerous articles and a monthly question and answer column for payroll publications. In addition, he regularly develops and presents webinars and presentations on a variety of topics including Payroll tax issues, FLSA compliance, and information return reporting.

Certification

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™, and SPHRi™ recertification through HR Certification Institute®? (HRCI®).

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™, and SPHRi™ recertification through HR Certification Institute®? (HRCI®).

Pedu Courses and Webinar or any Education published “Articles & Materials” strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pedu doesn’t support any Fake – News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

FAQ's

How do I get enrolled for this

webinar/course?

Sign up now on pedu.io. Visit pedu.io to discover a wide

range of webinars from industry specialists. Tick on either ‘live webinar’ or

‘on-demand’, and simply click on ‘buy now’ to get enrolled.

Can I get somebody else enrolled for

this course? If yes, how?

You can refer Pedu to anyone in your social circle.

Explore your industry with your colleagues by getting them signed up on pedu.io

today!

How can I access the live

webinar?

Go for the topic of your keen interest on pedu.io. Tick

on ‘live webinar’ and get enrolled! Easy registration, transparent

transaction.

Can I attend the webinar without an

internet connection?

You can request for an on-demand webinar that records the

live webinar for you. After the webinar ends, you will have full access to the

webinar’s recording.

What is an “On Demand”?

If you can’t attend the live webinar, simply go for the

‘on-demand webinar’ for the same price! Now, the live webinar recording will be

saved in a cloud storage for you to access anytime from anywhere.

Will the transcript be a hard-copy or

a soft-copy?

Pedu offer only soft copies of the webinars. It contains

all the highlights as well as comprehensive descriptions of the webinar, so you

never miss out a single detail.

Can I ask question(s) to the

speaker?

At the end of each webinar, you have the opportunity to

interact with your industry experts, where you will get answers to all your

queries.

I missed the live webinar. What

now?

Don’t worry, If you can’t join live webinar. Pedu has

automatically send you On Demand on your registered mail id after conducting

live webinar. So, you never miss out a single detail.

Isn’t it helpful?

Ask your question directly from our Customer

Support Team.