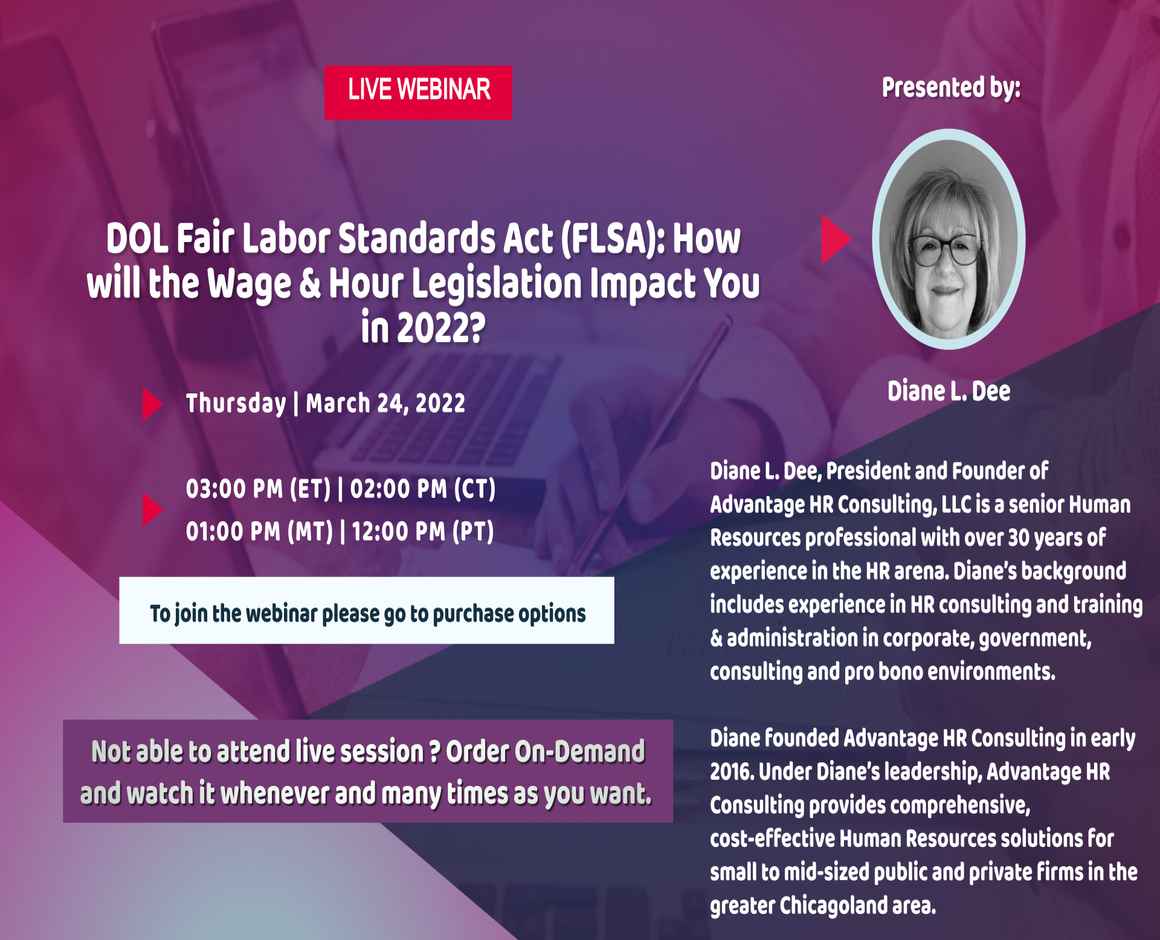

Overview

What does the FLSA say about the minimum wage requirements and overtime pay? How can you effectively calculate them? What are you obligated to follow in 2022? What are the provisions for 2021-2022? What does the violation of this Act bring for you?

The Fair Labor Standards Act (FLSA) or the Wage and Hour Act, was passed by Congress in 1938 and since has been amended many times. The major provisions of the Act are concerned with employee exempt/non-exempt status, minimum wage rates, overtime payments, child labor, and equal pay. With time, it has met regular updates to fit the regulatory environment of 2022.

Being in the U.S corporate industry, civil lawsuits for Wage and Hour violations are one of the biggest threats you’ll meet. If you’re an employer, potential violations of the FLSA can result in astronomical financial judgments against you. So understanding the provisions and requirements of the FLSA is crucial to ensure your organization’s compliance and to protect your company from major financial consequences.

Course Objective

Is your organization in compliance with the U.S. Department of Labor’s federal overtime pay requirements? Are you 100% sure? Employers need to know the facts and understand their options!

This training will provide you with a comprehensive understanding of the provisions of the FLSA. It will lay the groundwork to determine whether your employees are properly classified as Exempt or Non-Exempt. It will also help you ensure the wage and hour laws are being followed properly in your organization.

Additionally, you will learn the proper calculation of overtime pay, gain an understanding of what is considered hours worked, what to do when state and federal laws differ when employees must be compensated for training, travel time, meal breaks, and on-call status.

Areas/Topics Covered in the Session

- Upcoming changes to the Federal contractor minimum wage regulations in 2022

- What are the provisions of the Act?

- 3 tests you can use to evaluate whether an employee is exempt from the FLSA

- What are the changes in 2021 that affected tipped employees & retention of tips, changes to the salary threshold?

- What are the upcoming changes to the Federal contractor minimum wage regulations in 2022?

- Employee relationships v. contractual relationships for FLSA purposes

- What are the six exemptions considered under the FLSA?

- How can you accurately compute overtime pay?

- What timeliness do you need to follow for overtime payments?

- What does the FLSA say about the treatment of meal breaks, training, travel, on-call time and outside sales?

- What are the minimum wage requirements for 2022?

- What are the Equal Pay provisions under FLSA?

- What are the Child Labor laws for 2021-2022?

- Why is accurate record keeping so important and how to maintain it?

- What are the mandatory posting requirements you need to know?

Who Will Benefit?

- Senior Management

- HR Managers & Generalists

- Managers & Supervisors

- Compensation & Payroll Professionals

- Operations Professionals

- Employees