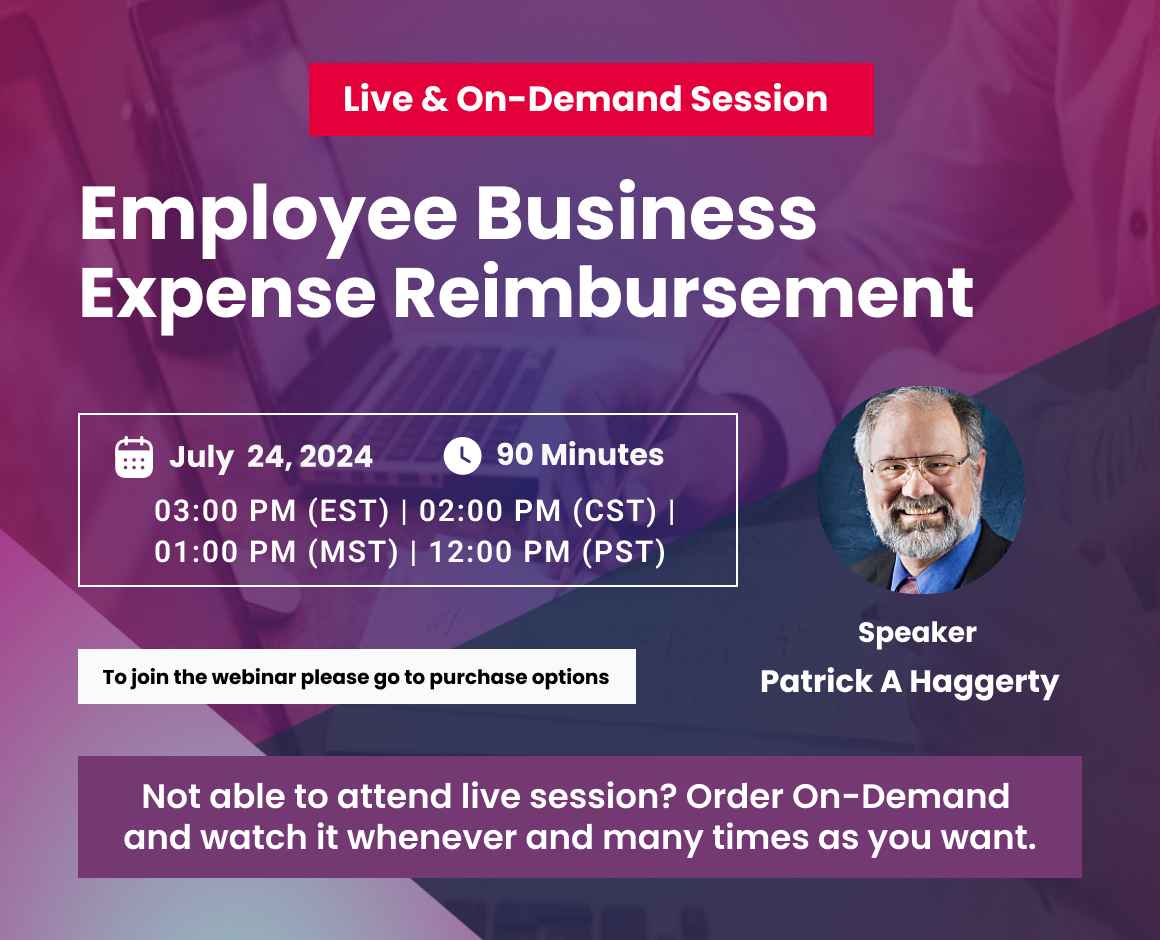

Overview

Employers often provide travel advances, business expense reimbursement, or use of company property to employees. Employee expense reimbursement is one of the targets of a current IRS audit initiative. Unless expense reimbursements are made under an accountable plan, the payments must be included in employee wages. Accountable expense reimbursement plans provide tax savings for both employers and employees. But insufficient documentation or faulty procedures can result in the reclassification of the reimbursements as wages. This results in additional tax and possibly penalties. An employer may even become liable for taxes it failed to withhold from the employee reimbursement.

In this informative webinar, you will learn how to properly account for and report expense reimbursements and facilities provided to employees in compliance with IRS requirements. Discussion includes work from home expense reimbursement.

Additional Information

This webinar will cover the tax compliance for employee business expense reimbursements under both accountable and non-accountable employee business expense plans.

While the Tax Cuts and Jobs Act (TCJA) did not change the treatment of employee business expenses reimbursed under an accountable plan, employee expenses that are not reimbursed under an accountable plan may no longer be deducted by the employee.

During COVID the number of employees working from home increased dramatically. In some cases, work from home has been extended beyond COVID restrictions. Reimbursement for work from home expenses have become a consideration for employers and, under certain state laws, is required. Work from home expense issues include documentation, taxability, valuation, allowable expenses, and treatment of allowances.

Accountable plans allow the employer to exclude expense reimbursement from employee wages. Accountable reimbursement plans have strict documentation and record-keeping requirements and require timely reporting and return of excess reimbursements by employees. For certain expenses, per diem arrangements can be used in lieu of actual substantiation of the amount of expense. The webinar will include a discussion of these requirements as well as how to report reimbursements that do not qualified under the accountable plan rules and must be included in employee wages.

Areas Covered:

- Employee business expenses and reimbursements under the Internal Revenue Code.

- Accountable and non-accountable expense reimbursement plans.

- Substantiation and documentation required to exclude reimbursement or benefits from wages

- Options for meeting substantiation requirements

- Advantages and effective use of per diem payments

- Work from home expense reimbursement

- How to control the risk of a “pattern of abuse” of per diem payments

- Valuation and treatment of personal use of company property (vehicles, cell phones, etc.)

- When expense reimbursements or use of company resources must be included in wages.

- Travel advance and payment card administration

- The importance of timely processing of reimbursements and collection of excess advance funds.

- Control and accounting procedures and the roles of payroll and accounts payable

Learning Objectives

As a result of this session, you should:

- Know whether an expense reimbursement qualifies for exclusion from employee wages.

- Know what is required to substantiate various expenses and benefits under an accountable plan.

- Understand the importance of timely processing of reimbursements and collection of excess advance funds.

- Know when expense reimbursements or use of company resources must be included in wages.

- Understand when per diem rates may be used and why employers may want to use them.

- Know how to determine maximum per diem rates and how to use the high-low method.

- Know how to establish and administer an accountable expense reimbursement plan.

- Understand the importance of control and accounting procedures related to expense reimbursement

Why you should attend

Unless expense reimbursements are made under an accountable plan, the payments must be included in employee wages. Accountable expense reimbursement plans provide tax savings for both employers and employees. But insufficient documentation or faulty procedures can result in reclassification of the reimbursements as wages. This results in additional tax and possibly penalties. An employer may even become liable for taxes it failed to withhold from the employee reimbursement.

Who will benefit

- Payroll Supervisors and Personnel

- Accounts Payable Supervisors and Personnel

- Public Accountants / Enrolled Agents

- Internal Auditors / Tax Compliance Officers

- Officers and Managers with Tax Compliance Oversight

- Company / Business Owners

- Managers / Supervisors

- Public Agency Managers

- Audit and Compliance Personnel / Risk Managers