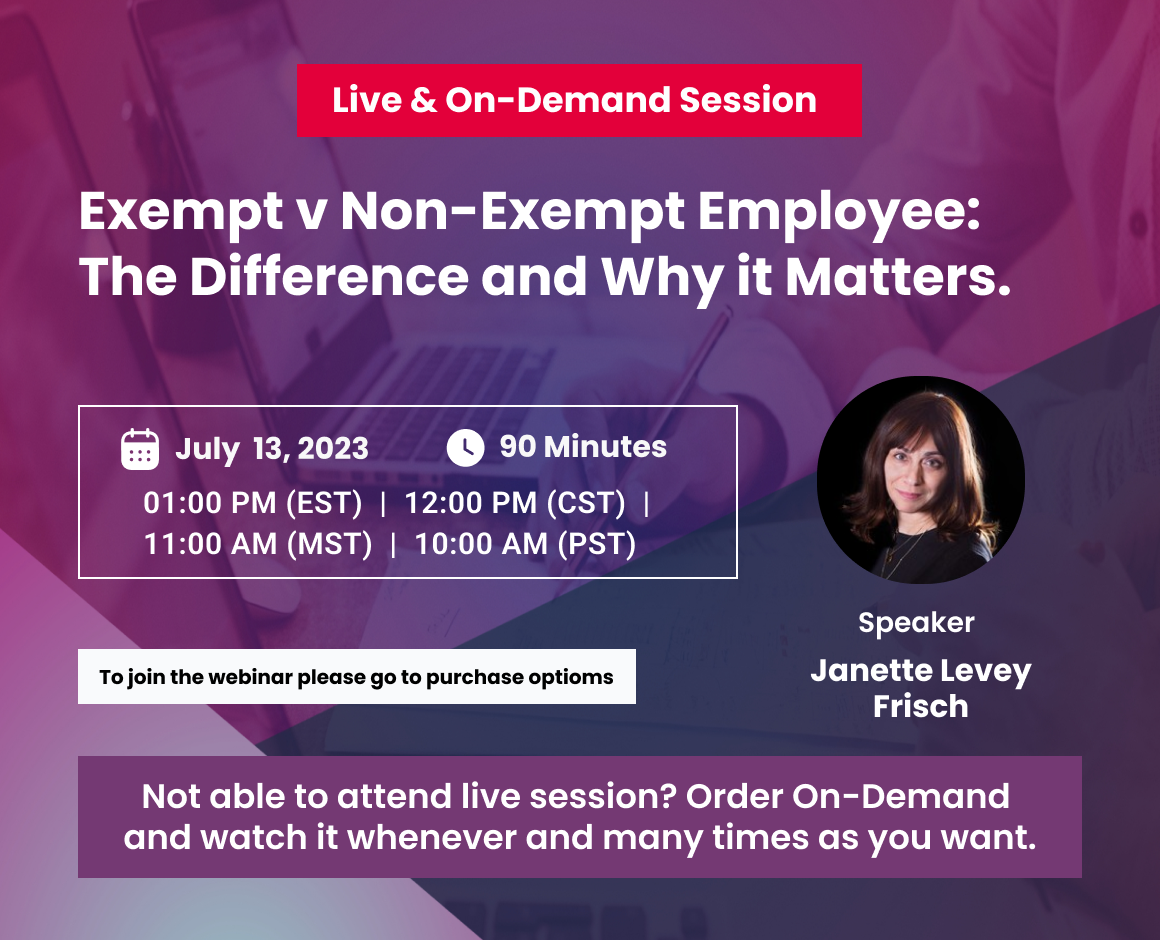

Overview/Description:

During the last decade or two, employers have found it increasingly difficult to decide which employees are entitled to overtime. Those classifications are commonly referred to as exempt employees (those who meet the FLSA’s requirements to be exempt from overtime pay) and non-exempt employees (employees the law requires to be paid overtime).

The FLSA contains dozens of exemptions, which basically provide that specific categories of employers and employees aren’t subject to the Act’s overtime requirements. Most common are the “white-collar” exemptions for executive, administrative, and professional employees, computer professionals, and outside sales employees.

What are these exemptions exactly? Who qualifies? What must you do to make sure that your employees are properly classified, and most importantly how can you make sure that your practices comply with the Fair Labor Standards Act so you do not fall prey to a Department of Labor audit – or worse, a lawsuit—resulting in unpaid overtime, liquidated damages, other fines, and penalties in addition to your legal fees? Join this webinar and find out!

Why you should attend:

While properly classifying an employee is challenging, ultimately, an employer’s life is much easier when it does so properly from the beginning. Misclassifying an employee as exempt can lead to an employer not only owing two or more years’ worth of overtime, but liquidated damages in at least the same amount (yes, at least double the amount of straight and overtime pay). Add to that, when an employer is found to owe an employee even one penny of straight and/or overtime wages, it can be on the hook for the employees’ attorney fees, adding up to a huge payout after protracted litigation. Learning the fundamentals and knowing when you need to get help from competent employee counsel goes a long way toward preventing those results. This webinar will get you started in the right direction.

Areas covered include, without limitation:

Areas covered include, without limitation:

- Difference between exempt v non-exempt employees;

- The salary basis test;

- The most common exemption categories;

- The duties test;

- Job Titles and Descriptions;

- Job Evaluations, Supervisor and Employee Interviews;

- Discretion

- Supervision

- Authority

- Case examples:

Pharma sales reps;

Auto service rep’s

Financial services employees

Who will benefit:

- Business owners

- CEO’s

- CFO’s

- Controllers

- Compensation Officers

- Payroll Administrators

- Human Resources Practitioners at all levels

- Senior Managers