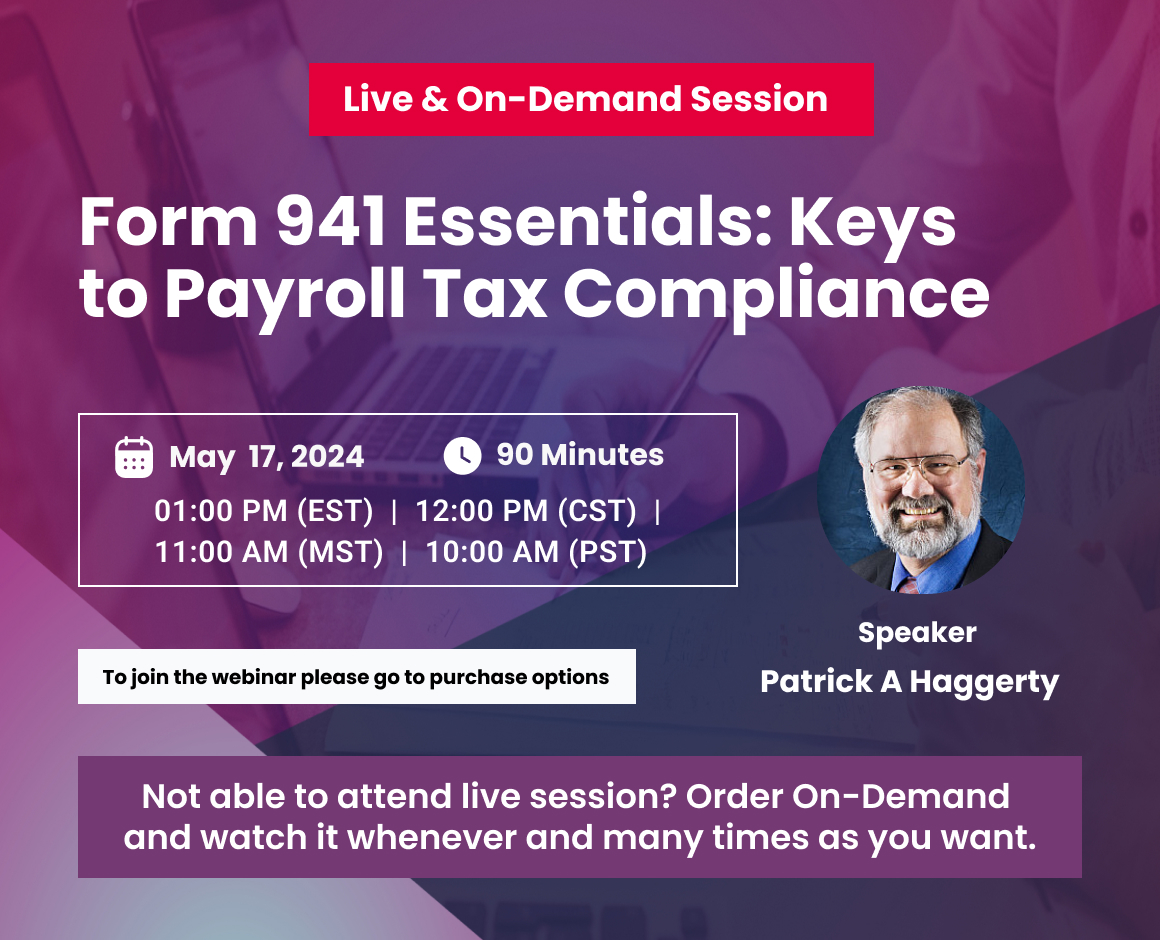

Overview

This webinar discusses the fundamental aspects of Form 941 including when to use Form 943, Form 944, or Form 945 instead of Form 941, determination of the tax deposit period due dates for deposits, a line-by-line walk-through of Form 941, special adjustments required for reconciling items and special rules that may apply for reclassified workers.

Description

The quarterly Form 941 reports employee headcount, wages, and tips, taxes withheld from employee pay and employer taxes, and tax liability dates that establish due dates for tax deposits. It is the basis for IRS determination of employer compliance with the requirement to withhold and deposit employee income tax and Social Security and Medicare taxes. The tax liability section and Schedule B provide the basis for IRS assessment of deposit penalties.

This webinar covers the fundamental aspects of Form 941 including when to use Form 943, Form 944, or Form 945 instead of Form 941. It also covers the determination of the tax deposit period and the due dates for deposits, a line by line walk through of Form 941, special adjustments required for certain reconciling items such as fractions of cents, uncollected Social Security and Medicare taxes on group term life insurance, and tips, and sick pay. Collection and enforcement of federal employment taxes is a current priority for the IRS.

Areas Covered:

- When to use Form 941 – Related Forms 944, 943, and 945

- Form 941 fundamentals - A walk through Form 941

- Return Due Dates

- Who should sign the Form 941 and what the signature represents

- Reporting third-party sick pay, group term life insurance, and tips correctly

- How to reconcile the Forms 941 with the Forms W2

- Tax deposit and reporting requirements – How to determine your deposit schedule

Learning Objectives

As a result of this session, you should:

- Know how to prepare an error-free Form 941

- Know when to use Form 941 or the related Forms 944, 943, and 945

- Understand what constitutes taxable wages and why the amounts are different for different taxes

- Know how to report tax amounts and how to make adjustments for rounding errors

- Know the filing due dates

- Understand the proper reporting of federal tax liability

- Know who should sign the Form 941 and what the signature represents

- Know when and how to report third-party sick pay, group term life insurance, and tips

- Understand the importance of reconciliation of Forms 941 with the Forms W2

Why you should attend

Form 941 is the link between payroll records and the IRS tax records. It is one of the most important compliance areas in payroll. Form 941 must be prepared correctly and reconciled with the quarterly payroll records. It must also be reconciled annually with third-party sick pay records and W-2 Forms. Proper administration of this vital form is critical for avoiding IRS notices and mitigating any penalties and interest that accompany them. The Schedule B is also a crucial form for many employers. Deposit liability dates must match the payroll records. These dates establish the deposit due dates and provide the basis for tax deposit compliance penalties.

Who will benefit

- Payroll Supervisors and Personnel

- Accounts Payable Supervisors and Personnel

- Public Accountants and Enrolled Agents

- Internal Auditors

- Tax Compliance Officers

- Officers and Managers with Tax Compliance Oversight

- Company / Business Owners

- Managers/ Supervisors

- Public Agency Managers

- Audit and Compliance Personnel / Risk Managers