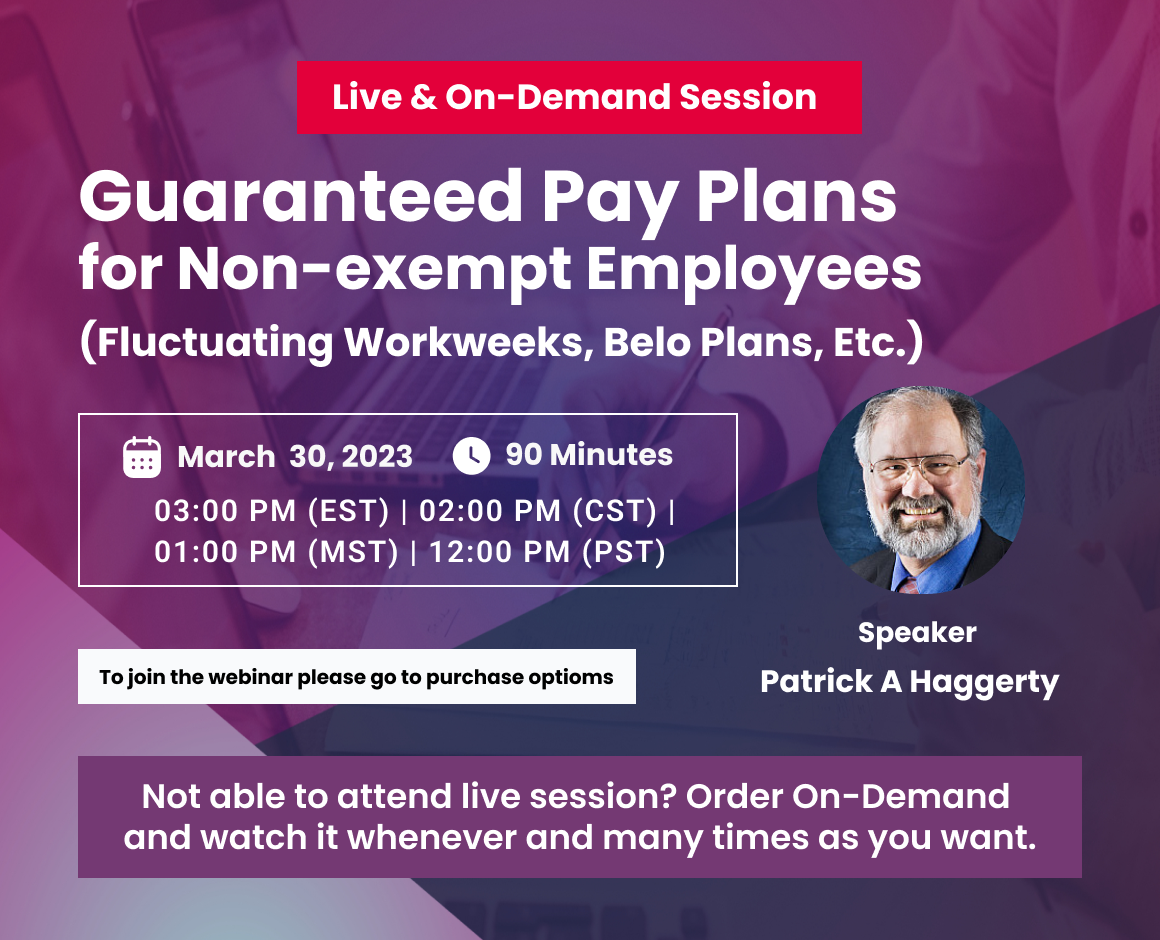

Overview

The amount paid to a nonexempt employee, even if salaried, is usually subject to adjustment with variations in hours worked. Where specific requirements are met, a nonexempt employee can be paid a fixed salary each workweek even though the hours vary from week to week.

Fixed salary plans include fluctuating workweek plans, Belo plans, and certain other guaranteed pay plans. However, to be compliant, these are subject to strict requirements. To establish a guaranteed pay plan, the employer must make sure employees understand how they are being compensated and agree to the payment plan as required. Employers must avoid practices that are considered as circumventing the minimum wage and overtime requirements of the FLSA.

Description

The Fair Labor Standards Act governs the minimum wage and overtime pay requirements of the nation’s workers. Under the FLSA, employers are required to pay employees, if not otherwise exempt, at least the federal minimum wage for each hour worked. Compensation for any overtime hours worked must be at least one and one-half times the employee’s regular rate of pay.

Generally, payment of a fixed salary regardless of hours worked is generally limited to exempt employees. The amount paid to a non-exempt employee, even if salaried, is usually subject to adjustment with variations in hours worked. However, where the requirements are met, a non-exempt employee can be paid a fixed salary each workweek even though the hours vary from week to week.

In establishing a guaranteed pay plan, it is important for the employer to make sure that the employees understand how they are being compensated and, in some cases, documentation of that understanding is required for the plan to be compliant. In some cases, the understanding on the part of the employee is sufficient for the employer to use the plan, however for some types of plans, the employee must also agree to be paid according to the plan.

Why attend

It is critical when implementing a guaranteed pay plan that an employer understands the requirements and rules for compliance with the FLSA. These plans do not reduce the need for employers to keep accurate records of hours worked. There are strict requirements for compliance.

It is also important for employers to know what to avoid. The Department of Labor has identified a number of plans that employers have attempted to use that do not meet the statutory requirements of the FLSA. Such plans include such things as artificial wage rates, split day plans, pseudo bonuses, or a low “regular” rate supplemented by employer provided “facilities”. Use of such plans can be costly to employers in terms of payment of back wages and penalties.

This webinar will help you:

- Know when a guaranteed pay plan makes sense for the employer.

- Comply with the recordkeeping requirements for fixed salary plans.

- Understand how a fluctuating workweek plan could be beneficial.

- Know which deductions from salary are allowed, and which are prohibited.

- Identify plans that fail to meet FLSA standards and why they fail.

- Know how to handle FMLA leave under guaranteed pay plans.

- Investigate how paid time off is applied to the fixed salary.

- Know when bonuses are allowed under a fluctuating workweek plan.

- Apply the half time pay method for of computing overtime compensation.

- Techniques used to control overtime costs.

- Assure fixed salary employees are properly compensated for overtime.

- Understand how Belo Plans differ from other guaranteed pay plans.

- Know whether workweek hours must fluctuate on both sides of forty hours per workweek.

Areas Covered

- Various types of fixed pay plans and when they make sense for the employer

- Record keeping requirements for fixed salary plans.

- Which deductions from salary are allowed, which are prohibited

- Plans that fail to meet FLSA standards and why they fail

- How to handle FLMA leave under guaranteed pay plans

- Applying paid time off to the fixed salary

- Bonuses and fluctuating workweek plans

- Overtime pay computations – the “half-time” method

- Control of overtime costs - non-standard schedules and seasonal employment

- How to assure fixed salary employees are properly compensated for overtime

Who should attend

- Payroll Supervisors and Personnel

- Payroll Consultants

- Payroll Service Providers

- Public Accountants and Enrolled Agents

- Internal Auditors

- Tax Compliance Officers

- Officers and Managers with Payroll or Tax Compliance Oversight

- Company / Business Owners

- Managers/ Supervisors

- Public Agency Managers

- Audit and Compliance Personnel / Risk Managers