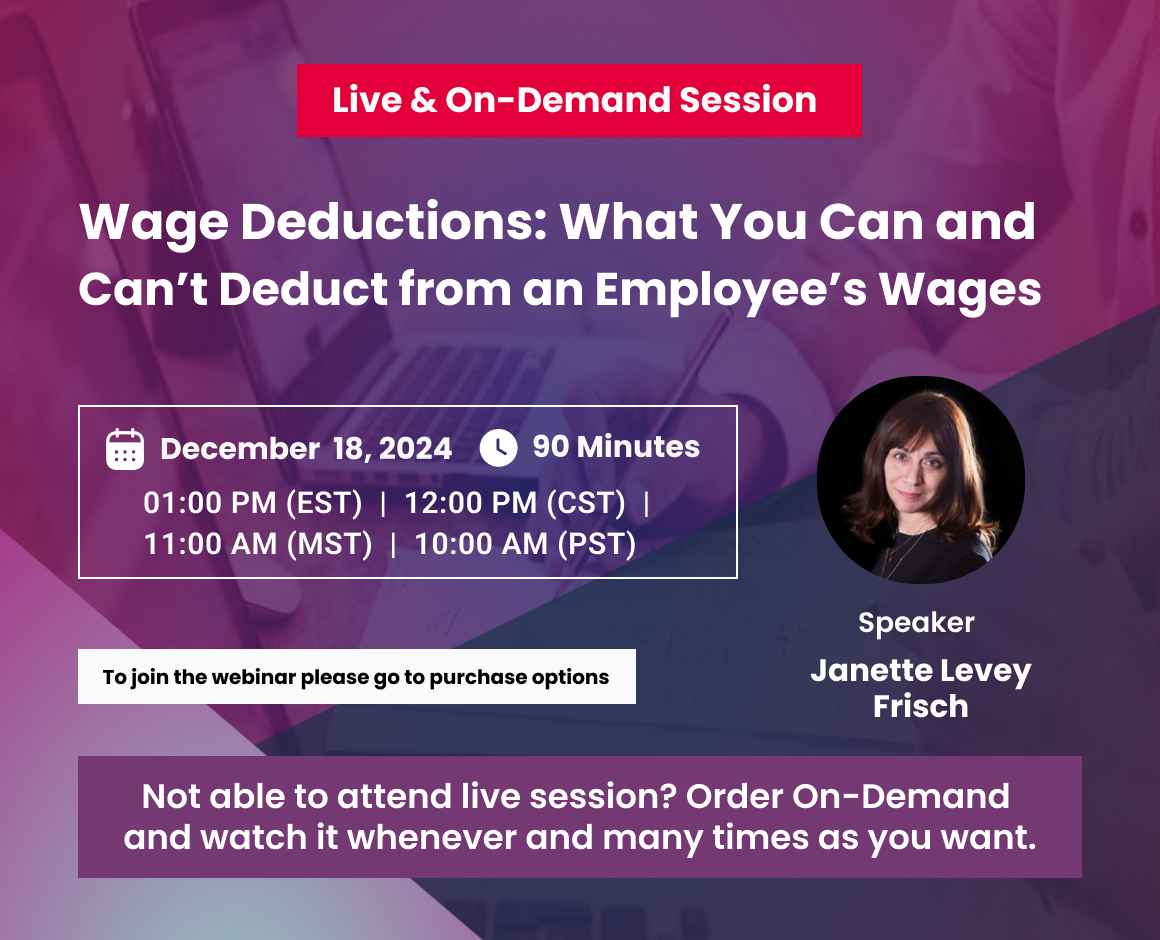

Overview

When paying an employee, employers are supposed to calculate an employee’s gross wages In payroll by meticulously following strict regulations regarding “hours worked” and “taxable income”. The employee then receives his or her “net pay”. But there’s a whole lot in between. What if an employee damages an employee’s property? Can the employer deduct the cost from the employee’s wages? Can you make an employee pay for a uniform or similar items? Are you adhering to applicable federal and state regulations: Failure to do so can result in substantial penalties and interest. In this 90-minute presentation we will offer insight into how to protect your company and stay compliant with laws regarding employee wage deductions. We will also discuss changes if any that have occurred recently, and, if depending on available information, potential changes we may see with a new President and administration.

Why You Should Attend:

In a nutshell, we will discuss what you as an employer can and cannot be deduct from an employee’s paycheck – both the regular and final one. We will include a brief overview of child support and its limits, federal and state tax levies, which credit garnishments you can and must honor, voluntary wage assignments for payday loans, fringe benefits and several other related topics.

What must an employer deduct from an employee’s wages? What can be deducted legally? What can never be deducted? These questions and more must be answered correctly before processing that paycheck. If you don’t deduct the proper income taxes, the IRS (and corresponding State Taxation Dept) might assess penalties. If you make other illegal deductions from an employee’s pay, the US and/or State Dept’s of Labor may come knocking on your door. Does your employee have any say over any of those deductions? In this webinar, we’ll explore the answers to these and many other questions.

Strict regulations apply to calculating an employee’s gross wages, particularly regarding what is counted as “hours worked” and “taxable income”. When deducting from an employee’s gross wages to determine net income, an employer must adhere to the regulations or risk being subject to penalties and interest, which can add up to significant amounts. In this webinar, you will learn how to protect your company while complying with wage deduction laws. We will focus primarily on federal laws and general legal principles that apply to all (or most) states and may use some specific state examples as well.

Areas to be Covered include, without limitation:

- Taxes—which are mandatory, which are a courtesy, and which ones the employee controls;

- Child support—the limits but not beyond

- Tax levies—federal and state

- Creditor garnishments—how many can you honor and how often

- Voluntary wage assignments for payday loans—when are they required to be honored;

- Fringe benefits (e.g., health insurance, group term life)

- Uniforms

- Meals—can they ever be part of the employee’s wages?

- Lodging— employee’s wages or a perk?

- Shortages—can you deduct them from wages?

- Breakage—does an employee have to pay for them out of wages?

- Overpayments—how do you recoup them?

- Advanced vacation pay—can you take them back when the employee quits?

- Loans to employees: what terms can you set what you do when the employee leaves or is terminated?

- Employee purchases

- Anti-wage theft laws and the states

Who Will Benefit:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Legislators

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements Payroll Compliance and are considering making a change in Payroll Frequencies